Stadelman encourages Rockford residents to use free credit checks during pandemic

- Details

- Category: Press Releases

ROCKFORD — Determined to assist Rockford residents navigate their finances after months of economic hardship due to the COVID-19 pandemic, State Senator Steve Stadelman (D-Rockford) is highlighting credit reporting websites that are offering their services for free.

“No one could have predicted the financial hardships that are plaguing residents across our communities,” Stadelman said. “Credit reporting services can be tedious and people shouldn’t have to pay to know what their credit score is. I’m encouraging people to use the free services that are available.”

Everyone is now eligible to receive their weekly credit report for free through Equifax, Experian and TransUnion through April 2021. For more information, please visit www.AnnualCreditReport.com.

“Checking your credit score on a regular basis can make you more aware of what affects it the most,” Stadelman said. “As we continue to live through these truly unprecedented times, one of the best things we can do is remain financially vigilant.”

Stadelman emphasizes funding for e-learning and federal support for Rockford Public Schools

- Details

- Category: Press Releases

ROCKFORD – Yesterday, Governor Pritzker signed into law a measure that will provide assistance to teachers and schools in light of the challenges they continue to face during the COVID-19 pandemic.

State Senator Steve Stadelman (D-Rockford) supported that measure and has called for additional federal aid to help Rockford Public Schools weather the pandemic and implement e-learning.

“The federal funds for Rockford schools, in addition to this law, will help Rockford area schools make the changes they need to guide our children through this crisis,” Stadelman said. “Both the funding and the law support e-learning at home – an important safety precaution that may still be necessary in the fall.”

The education package extends teacher license renewals for one year, so teachers don’t have to go through the renewal process while working remotely. It also allows for mandatory tests to be taken remotely, so students don’t have to risk getting sick in order to take an exam they need to apply for college.

Senator Stadelman's Weekly Bulletin

- Details

- Category: Latest

Stadelman, West deliver $2 million to keep Medicaid patients at Mercy

In an effort to preserve services for Medicaid patients at one of the area's three primary medical providers, State Senator Steve Stadelman and Rep. Maurice West secured $2 million in funding for Mercyhealth when Illinois lawmakers approved a budget for the new fiscal year that begins July 1.

Javon Bea Hospital is one of nine statewide that are designated to receive $19.8 million from the Illinois Department of Public Health to support care of low-income patients, Stadelman and West announced today. Gov. JB Pritzker signed the budget legislation last week.

Seven of the hospitals are in Chicago, and one is in the St. Louis metropolitan area. The money is intended to help hospitals with the highest percentage of Medicaid patients and those disproportionately affected by the COVID-19 pandemic.

Mercyhealth, which operates hospitals on Rockford's northwest and far northeast sides, drew sharp criticism with its announcement in April that an estimated 66,000 patients receiving Medicaid benefits through four Managed Care Organizations would need to find new doctors amid the pandemic as soon as July 21. Mercy also closed its Pediatric Intensive Care Unit.

Stadelman and West hope the $2 million in operational assistance gives Mercy an incentive to continue its MCO agreements. The funds are reserved for "hospitals that participate in the state's Medicaid managed care program," meaning Mercy would forfeit the money by declining to change its position.

"My desire is to see the most vulnerable in our community enjoy the same continuity of care as those who are more fortunate," Stadelman said. "We fought for Rockford to be included in this funding with the belief that some extra backing from the state may encourage Mercy to look out for low-income families."

Added West, "The last thing that Medicaid patients need is the uncertainty and fear of what is going to happen to their healthcare during a pandemic. The fight for more funds to Mercyhealth is to ensure that healthcare remains accessible to everyone in Rockford, no matter what zip code you live in or your level or income.”

Mercy had 90 days to notify patients of its intent to sever its MCO agreements. Three of them end next month; one remains in effect until October.

Stadelman and West also are advocating for an increase in Medicaid managed care reimbursement rates, which they say are vital to providing access to health care for all citizens of the Rockford region.

Both lawmakers also are working with IDPH and UW Health to accommodate Medicaid patients within the SwedishAmerican health network. IDPH has requested Rapid Response Plans from each MCO, which include a communication to patients and plan for integrating them into a health system within 60 miles or 60 minutes of where they live.

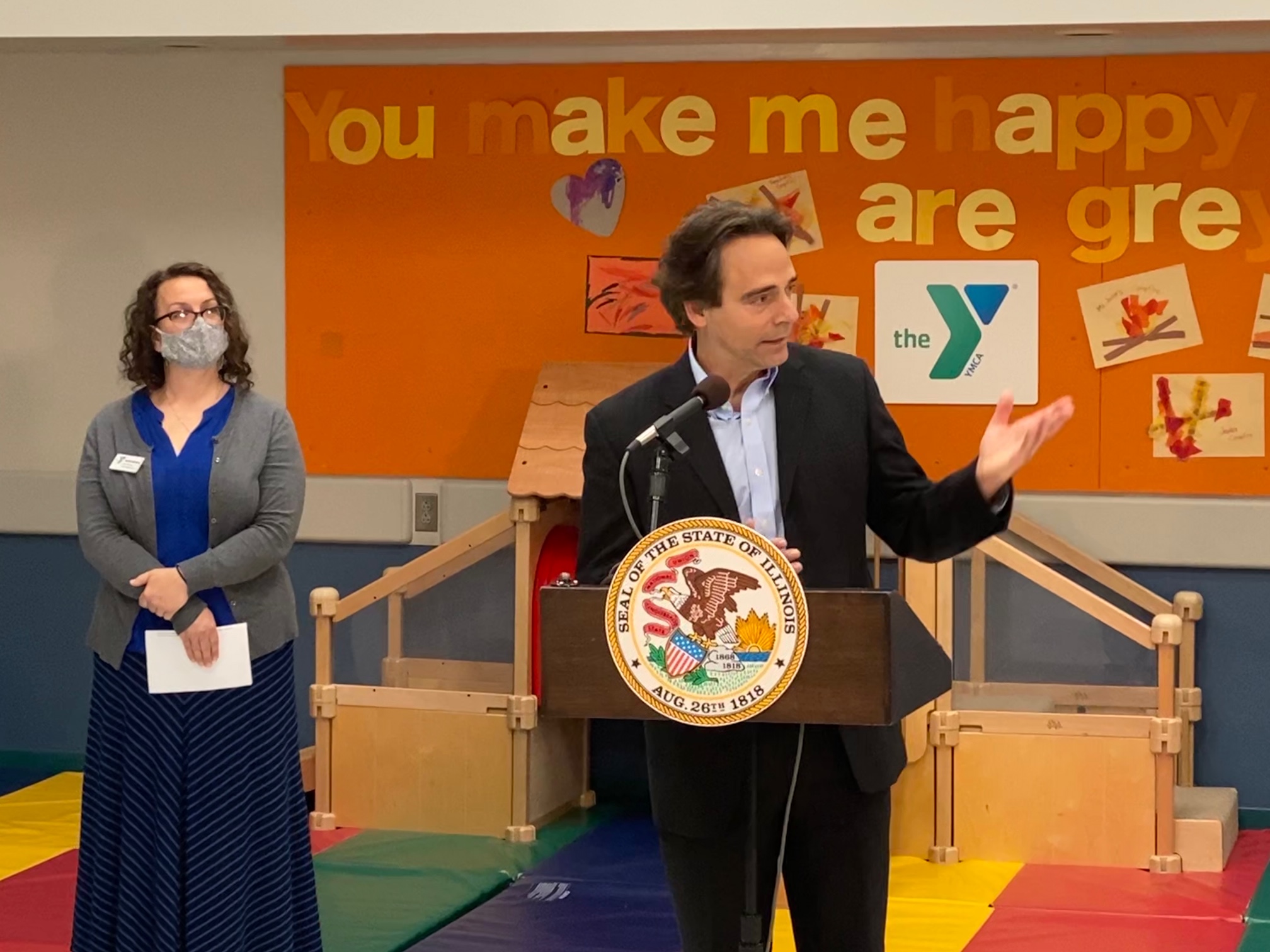

Stadelman announces $270 million grant program for child care providers

State Senator Steve Stadelman joined Illinois Gov. JB Pritzker along with child care providers, local officials and parents during a visit to Rock River Valley YMCA Children’s Learning Center to announce a $270 million Child Care Restoration grant program.

The program is the first of its kind in the nation and will support child care providers as they continue to watch children across the state during the COVID-19 pandemic.

“This is not only an investment in our youth. It’s an investment in our communities,” Stadelman said. “This pandemic has created many new challenges for Illinois, but it has not changed the state’s commitment to our children.”

The Child Care Restoration grant program will dedicate $270 million of the state’s Coronavirus Urgent Remediation Emergency Fund to support the economic health of child care providers as the state’s economy continues to reopen in the coming weeks and months

An “Intent to Apply” survey is available online. The information gathered will help inform development of the grants program to be released in July 2020. Qualifying providers will receive their first payments later this summer. The survey will close at 5 p.m. June 19.

Stadelman backs law to ease financial burden for property owners

As the state moves toward the next stage of recovery from the COVID-19 pandemic, property owners will see financial relief under a measure supported by State Senator Steve Stadelman and recently signed into law.

“Residents across Illinois have faced severe financial hardships over the past few months, and property taxes are often a burden for families living on fixed incomes,” Stadelman said. “Any form of relief during these times can help alleviate some of the pain people are experiencing.”

Under the legislation, local businesses and residents will see property tax relief in the form of:

Empowering county governments to approve 2020 homestead exemptions for those with disabilities, veterans with disabilities and senior citizens, as long as the property had been granted this exemption for 2019.

Allowing counties with fewer than 3 million residents to waive interest penalties and fees for late property tax payments due in 2020

Deferred property tax sales.

“Giving homeowners some flexibility on property taxes is a necessity in our current economic situation,” Stadelman said. “Everyone has been effected by this pandemic.”

The legislation took effect immediately June 5.

Stadelman announces $270 million grant program for child care providers

- Details

- Category: Press Releases

ROCKFORD – Today, State Senator Steve Stadelman joined Gov. Pritzker along with child care providers, local officials, and parents during a visit to Rock River Valley YMCA Children’s Learning Center in Rockford to announce a $270 million Child Care Restoration grant program.

The program is the first of its kind in the nation and will support child care providers as they continue to watch children across the state through the COVID-19 pandemic.

“This is not only an investment in our youth. It’s an investment in our communities,” Stadelman said. “This pandemic has created many new challenges for Illinois, but it has not changed the state’s commitment to our children.”

The Child Care Restoration grant program will dedicate $270 million of the state’s Coronavirus Urgent Remediation Emergency Fund to support the economic health of child care providers as the state’s economy continues to reopen in the coming weeks and months.

Stadelman was also joined by Rockford Mayor Tom McNamara.

The Department of Commerce and Economic Opportunity, in partnership with the Illinois Department of Human Services, is charged with developing the grant program for licensed child care providers. The Child Care Restoration Grants will be administered by the Illinois Network of Child Care Resource & Referral Agencies.

The “Intent to Apply” survey launched today and is available online HERE. The information gathered will help to inform the development of the grants program to be released in July 2020. Providers that qualify will receive their first payments later this summer. The initial survey will close on June 19, 2020 at 5 p.m.

More Articles …

Page 76 of 125